I often get asked “How do I know what business to choose when investing?”. This article will cover the principles I follow when investing in stocks and briefly explain it from my understanding.

Choosing a great business that has great returns is always a tricky factor and remember no investment is risk free, but Phil Town’s 4 M’s are great to follow – in this case I follow 2 to 3 of the M’s when looking at a business and as you get comfortable with investing you start digging deeper.

The 4 M’s you may apply to investing in businesses (This doesn’t really apply to ETF’s or Unit Funds):

Meaning

What does this business mean to you, always invest in industries or businesses you can understand. There’s no point in investing money into a company or industry you have no idea about. It’s difficult to value a business if you have a feeling or hunch what they do. Invest in companies you believe in and understand their products or business model. Don’t invest in a company just because your friends or colleagues are.

Moat

This terminology get’s me excited as I find this is a great “M” in choosing a business to invest in. Think of it as a business defense system, like a moat in a castle back in the 1600s for example. What makes the business you are looking at safe from competitors think of a secret sauce or patented technology. If the business sells a product or service that stands out and isn’t easily replicated, this makes a great moat or defense system.

Margin of Safety

This is also crucial to securing your investment and reducing your investment risk. There are formulas to get a clearer estimate of the future value of a share should things should continue as is. For the sake of this article I’m not going to dive into these formulas.

A great tool to automatically see this is https://simplywall.st, they have their own analysts to get a fair value and should a stock be undervalued this means your risk reduces as it’s actually worth more.

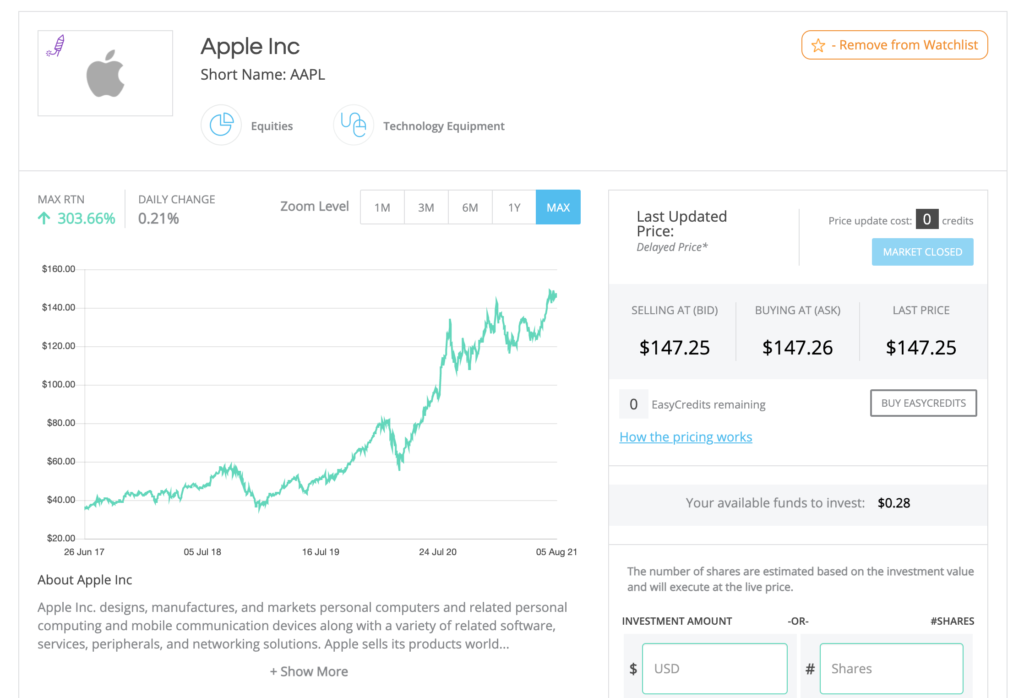

Another thing I look out for is the 1 Year, 5 Year and all time graph of a share price. You want an overall upward trend and buy in short-term dips. Let’s look at $AAPL as you can see this long term graph looks good (however the price is a little high at the time of this article):

If the above graph was reversed, would you invest in the business or would you rather invest in a company like Apple that’s moving upward. Watch the stock closely, and buy when it dips to reduce risk even further.

Management

It’s always good to see how the management of the company are handling the funds, their salaries and bonuses and plans for the business. CEO’s and other managers often milk companies for high salaries – if a business is losing money year over year, should the CEO get a couple of million dollars as a year end bonus?

Buying shares in a popular business often has good management already, so I don’t dig too deep into this.

Here is a full break down of the 4M’s for BP by Phil Town – https://www.ruleoneinvesting.com/blog/how-to-invest/4m_analysis_bp/

Photo by Sharon McCutcheon on Unsplash