Since I’ve been more actively looking for investments, there’s really a lot to choose out there. This guide will help you tell if an investment is a scam – I use this for my personal judgement when looking at a new investment.

The Red Flag List

- 🚩 Guaranteed (ridiculous) return on investment – anything over 15% per annum.

- 🚩 Daily, weekly or monthly returns. You should be on high alert.

- 🚩 Claiming little to no risk (and high returns).

- 🚩 Invite people to earn a portion of their returns (Pyramid Scheme)

- 🚩 Claims one thing, but does another.

- 🚩 Invite only investments.

- 🚩 Unable to get your initial investment back (“locks” it away indefinitely)

Guaranteed High ROI’s

There are a lot of great investments that offer guaranteed return on investments. This doesn’t automatically make the investment a scam – when the guaranteed investment guarantees a really high amount (I usually work on anything above 15% per annum) slow down and research this investment more thoroughly before diving in.

If an investment will be making you 50% in a short-term, why would the investors need your money when they could keep these trade secrets to themselves. I always feel that if an investment offers a ridiculous amount in returns why aren’t financial advisors just jumping on the bandwagon and offering something like 20% a year return and pocket the 30% ROI for themselves as a nice commission?

Always try to see if the investment is registered with the FSCA (Financial Sector Conduct Authority) or something similar in the industry you’re investing in.

Aggressive Compounding Returns (Daily, Weekly or Monthly)

These return frequencies are becoming a bit more common, especially in the crypto space, but I still slow down when I see this jargon being thrown around on investment fact sheets. This is to reel you in, as we all want a get rich quick scheme – unfortunately these don’t exist otherwise the already millionaires and billionaires would be bullish on this don’t you think?

Let’s do some quick math to prove the theory why wildish compound returns just aren’t sustainable or real to last:

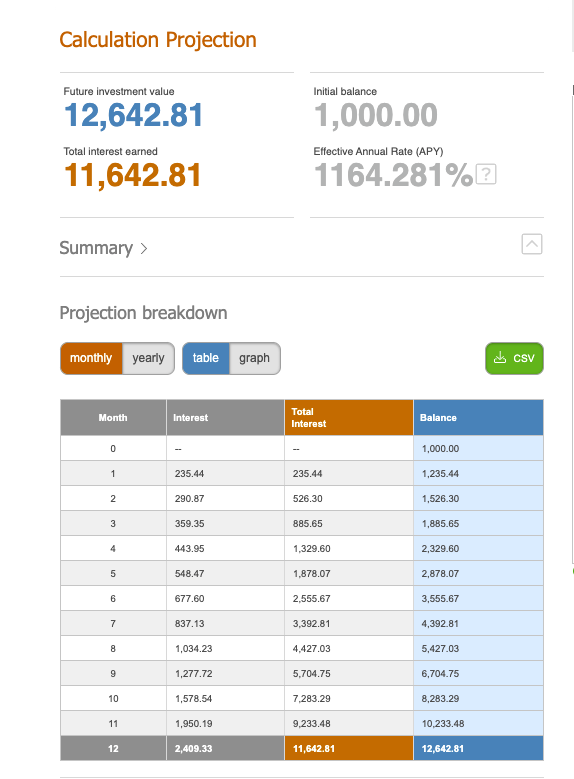

I’ll be working on a 5% a week ROI, and remember there are more aggressive ROI’s available. Let’s say you invest R1000 that returns you 5% each week in some crypto project, and assume that whatever crypto asset it is doesn’t depreciate or appreciate whatsoever for a 52 week period.

Overview:

- R1000 initial investment

- 5% return each week, compounding

- 52 week period (1 year)

- No ongoing deposits whatsoever, just R1000 compounding each week.

After the 52 weeks, your R1000 will have earned you R11642.81 within a 52 week period. Talk about 10x’ing your money.

Calculations were done using compound calculator here – https://www.thecalculatorsite.com/finance/calculators/compoundinterestcalculator.php

If you leave this R1000 compounding, again no deposits whatsoever, for a 3 year period you would have earned a little over R2 million rand – wouldn’t every person do this with much higher initial investments and just leave it?

This is a huge red flag, as often these returns string you along to re-compound or lock your ROI’s in to keep it growing or you lose out. I’m sorry I just don’t buy it. If you ask anyone that’s in one of these schemes for a while you can ask them if they’re millionaires yet – I can already tell you they aren’t.

Invest cautiously. Invest what you can afford to lose. Do your own research and make informed decisions.

Where or how are these projects getting the funds to pay out these investors in a year or two? Imagine you just invest R1000 and compound like this from your child’s birth until they’re 18.

No Risk/Little Risk and High Rewards

There is absolutely no investment that is risk free or has less risk than holding it in a bank’s saving account with 100x return on your investment – these are often above high risk and just put simple Too good to be true.

If an investment claims it’s 100% risk free, run far far away.

MLM/Pyramid Schemes

You get a bunch of great affiliate marketing/rewards in investments and this differs from a MLM or pyramid scheme. If you have to be invited especially to an investment opportunity, or inviting members starts ramping up your return rate or better rates the more people you invite (I’m not talking about some credits or discounts to use services but actual money in your bank) this is a huge red flag. These systems are designed to make the owners of the scheme rich and take you for a ride. If this is required or a huge part of the investment stay clear!

Source of returns (Crypto)

There should always be a “cost” of the returns, where does the revenue come from?

Investments, especially in the crypto space promise you a return or a specific amount when joining – known as an airdrop. Don’t fall for this, you can’t sit on your couch and make thousands of rands (or crypto) by doing nothing and returns coming from thin air.

Anyone can create a crypto token, and at the time of writing there is over 20,000 tokens available to invest in. This means you have to be extra careful, and invest amounts you’re willing to lose. Tokens need to have utility in order to be sustainable – would you invest in magical money that cannot be used outside of the game and cannot be used for any real world applications?

Read the Fine Print

If an investment or project claims to do something, be it burn tokens in crypto, or have an offshore account in some country you’ve never heard of and it doesn’t stick to these promises be suspicious. All these fancy words and jargon is used to real in with your initial investment – that’s all that’s needed to line the owner’s pockets and does not have your interest at hand.

If the project or management cannot keep their word on simple stuff, they’re most likely doing something else behind the curtains.

Wrap Up

If an investment ticks any of these points, it almost defaults me to an immediate no-buy and forces me to start looking at other opportunities that are in line with my profile. I work hard for my money and I’m not going to carelessly invest in some trojan horse investment. I’d rather stick to something that will give me lower, more realistic returns but I know it’s in a legitimate project or business – I’m in it for the long run and finding stability and reliability is key (Read my post about choosing a great business when investing)

You know the drill, if you have any comments or want to share projects that you’ve been burned by or factors you look out for in an investment leave a comment below. I leave you with the following phrase I’ve heard by a few people investing:

If it’s too good to be true, it most probably is.